久银控股“投资+投行”业务模式研究 MBA硕士论文

久银控股“投资+投行”业务模式研究

专业:工商管理硕士

硕士生:

指导教师:

摘要

受宏观经济下行、监管政策趋严和行业竞争加剧等多重因素影响,私募股权基金大多面临募资难、投资难、退出难等困境。私募机构亟需在当前激烈的竞争环境中创新业务模式,建立其自身优势。

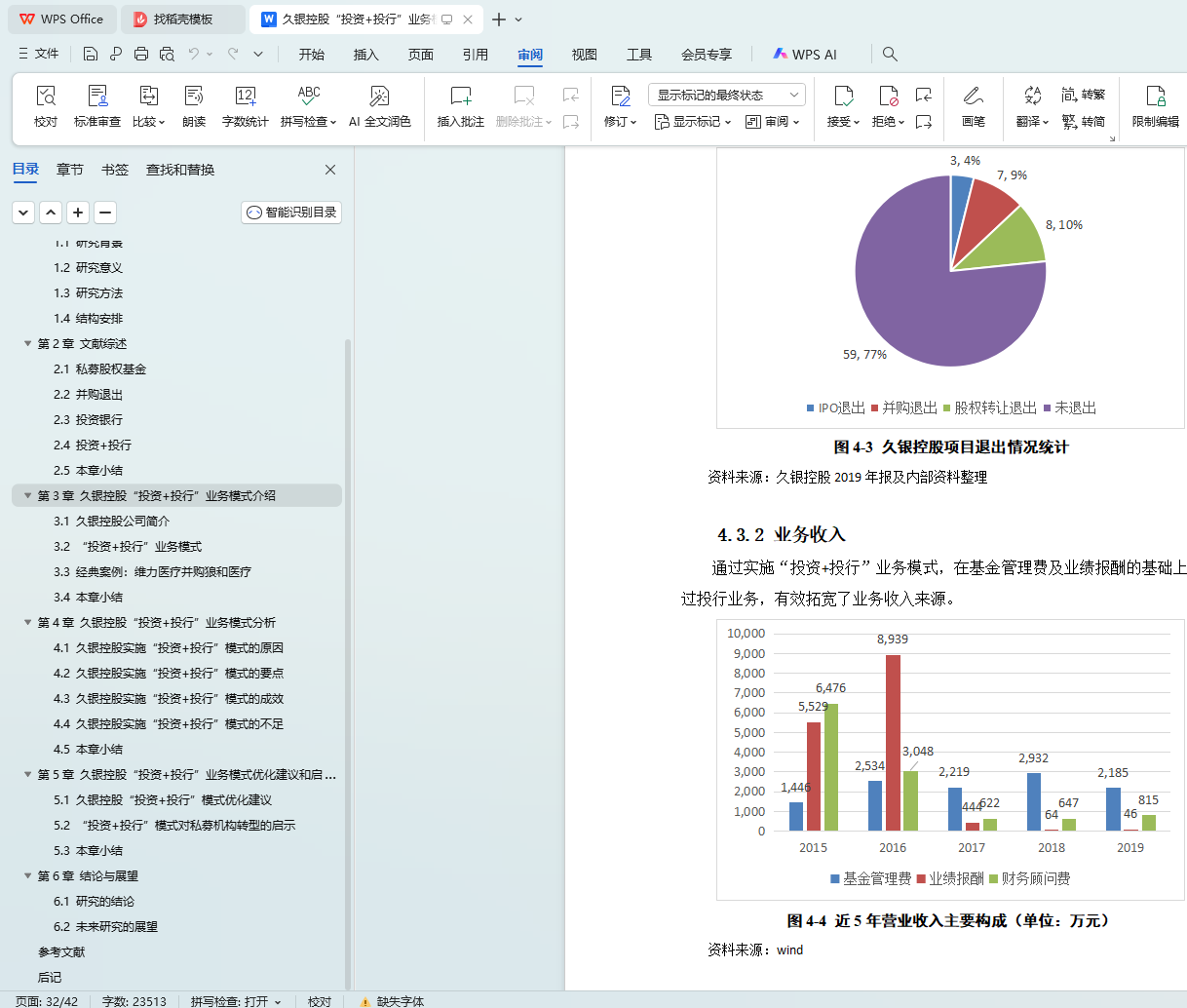

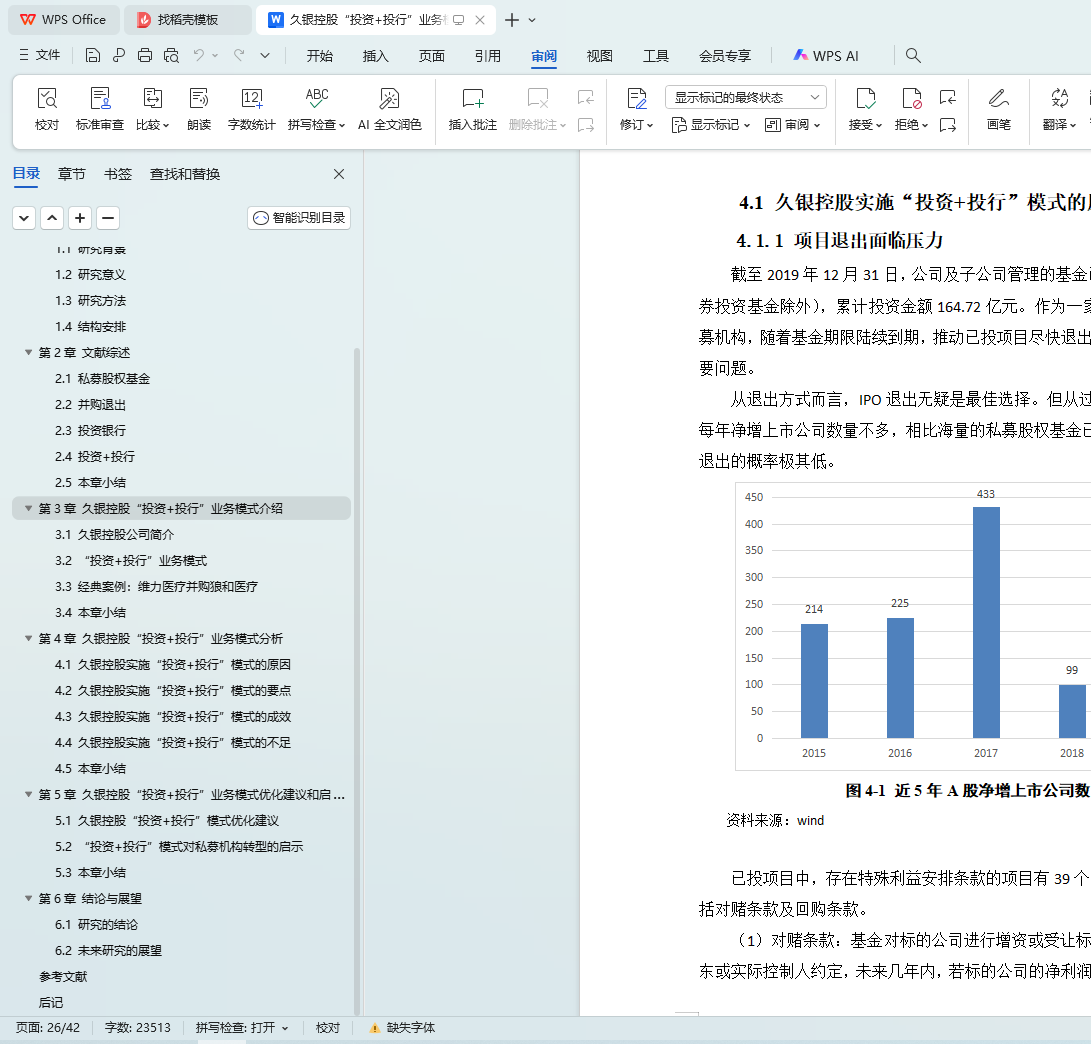

本文以在新三板挂牌的私募机构久银控股作为案例公司,通过文献分析及案例研究的方式,探讨“投资+投行”业务模式的利弊及优化建议。主要的结论归结如下:首先,“投资+投行”业务模式可以有效降低项目退出难度,缩短项目退出周期,通过并购退出获取可观的投资收益,有利于私募股权基金“募、投、管、退”的良性循环;其次,“投资+投行”业务模式实现私募机构业务收入的多元化,通过投资银行业务提升经营业绩,改善经营现金流;最后,“投资+投行”业务模式的实践经验有较好的参考意义,可为其他私募机构拓展退出渠道、构建自身竞争力提供一种新的视角。

关键词:私募股权基金,并购退出,投资银行,投资+投行

Research on the "investment + investment banking" business model of EAGLE HOLDINGS

Major: Master of Business Administration

Name:

Supervisor:

ABSTRACT

Under the influence of multiple factors such as macroeconomic downturn, stricter regulatory policies and intensified industry competition, most private equity funds are faced with difficulties in fund-raising, investment and exit. Private equity institutions need to innovate business models and establish their own advantages in the current fierce competition environment.

This paper takes EAGLE HOLDINGS, a private equity firm listed on the new third board, as a case company. Through literature analysis and case study, this paper discusses the advantages and disadvantages of "investment + investment banking" business model and optimization suggestions. The main conclusions are as follows: firstly, "investment + investment banking" business model can effectively reduce the difficulty of project exit, shorten the project exit cycle, and obtain considerable investment income through M&A exit, which is conducive to the benign cycle of private equity fund; secondly, the "investment + investment banking" business model can realize the diversification of business income of private equity institutions Finally, the practical experience of "investment + investment banking" business model has good reference significance, which can provide a new perspective for other private equity institutions to expand exit channels and build their own competitiveness.

Keywords: Private equity fund, M&A exit, Investment bank, Investment + investment bank

目录