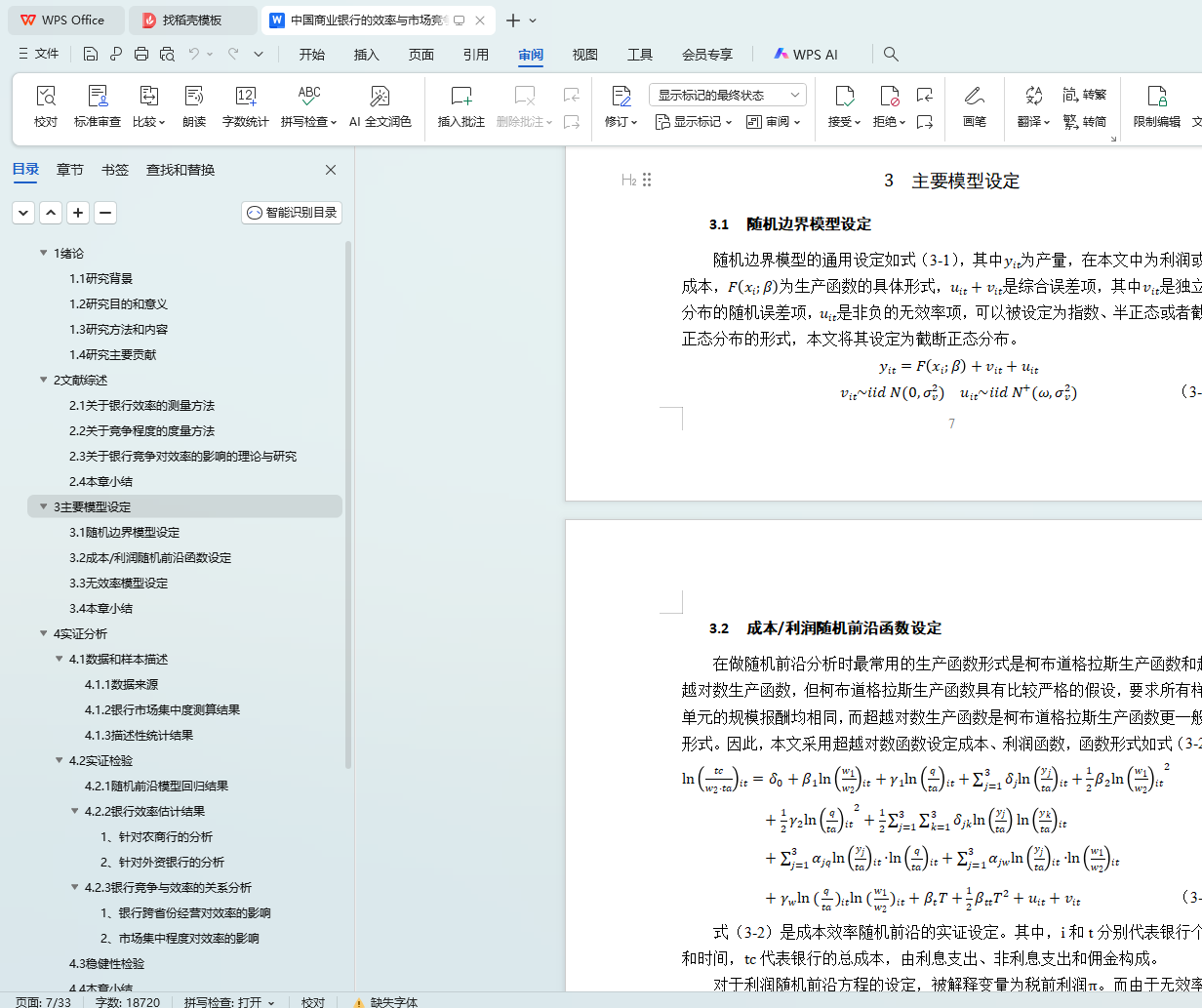

中国商业银行的效率与市场竞争 论文定稿+初稿+选题方向+论文笔记+参考文献+实证分析及数据

中国商业银行的效率与市场竞争

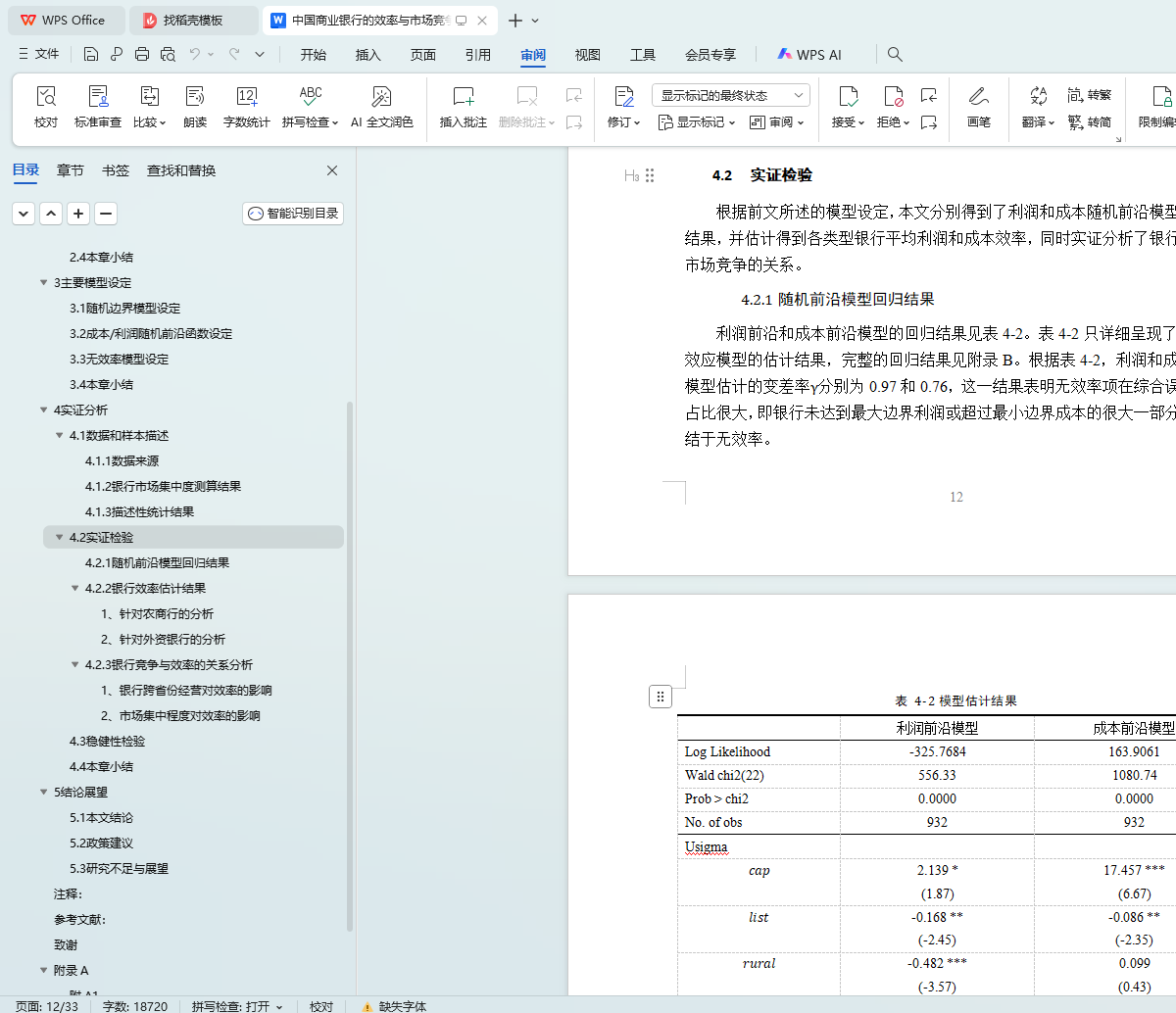

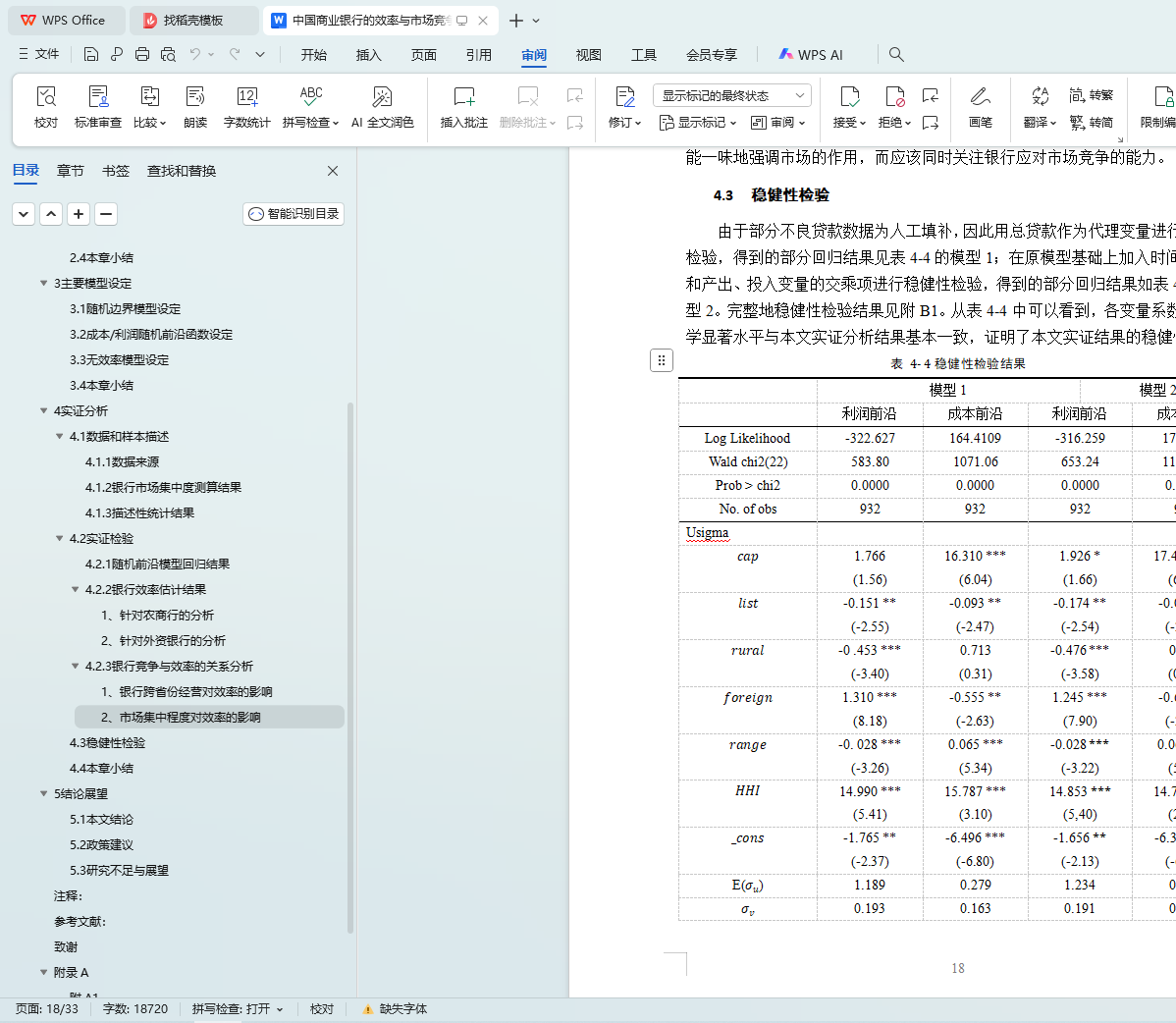

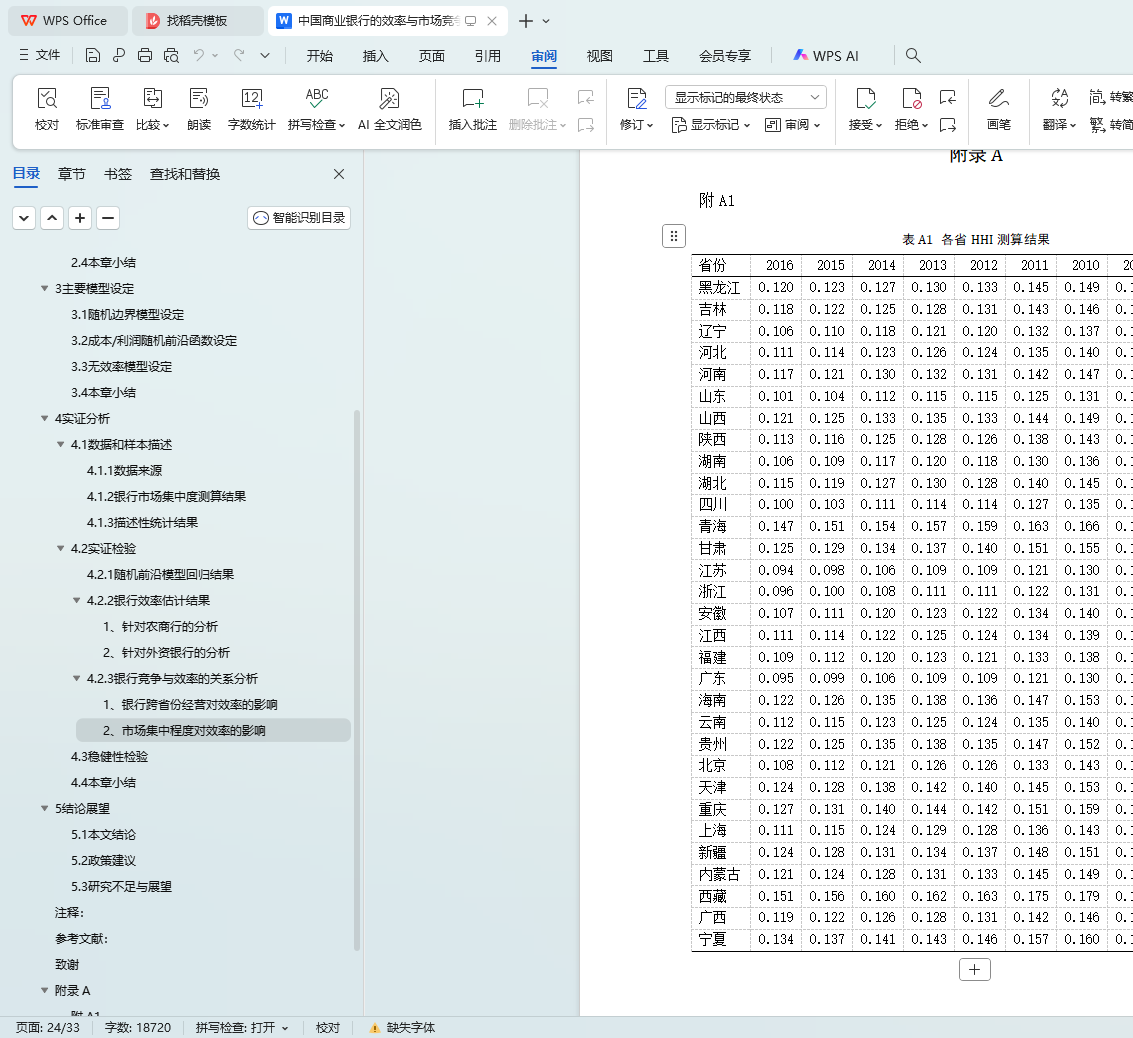

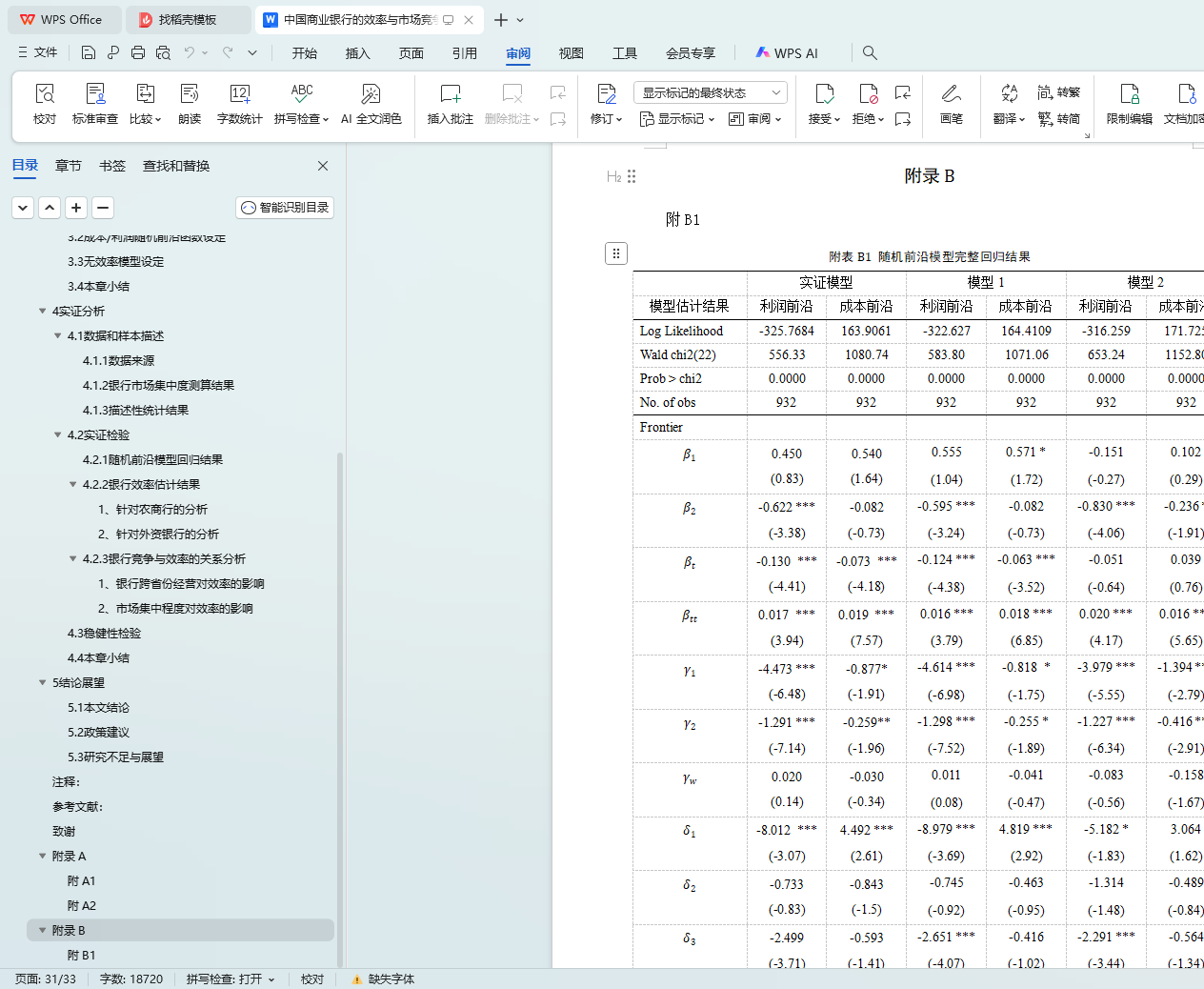

【摘要】本文关注了以往文献中较少被研究的农商行和外资银行的效率表现,创新地计算了银行市场集中度指标――赫芬达尔指数(HHI),通过单阶段随机前沿分析模型分析得到适用于中国的竞争与效率的关系。本文结论如下:其一,十年间我国商业银行效率整体呈现上升趋势,农村商业银行得益于近年来国家的优惠政策而实现了较高的经营效率,而外资法人银行的利润效率远低于整体银行水平;其二,我国商业银行面临的市场竞争不断增加,各类型银行市场竞争程度与其在我国银行业的实际市场势力相匹配;其三,银行业市场竞争程度的增加能够有效提高商业银行的成本和利润效率。

【关键词】商业银行效率;随机前沿模型;市场竞争

【Abstract】The paper pays special attention to bank efficiency of Rural Commercial Banks (RCBs) and Foreign Banks(FBs), which were rarely studied in past researches. By measuring the Herfindahl-Hirschman Index (HHI) of bank market in an innovation way and involving it in the one-step stochastic frontier analysis approach, the paper examines the relationship between bank efficiency and market competition. The conclusions are as follows: Firstly, the efficiency of commercial bank in China experiences an upward trend over the data period of 2007-2016, with RCBs outperforming other banks while FBs have poorer performance; Secondly, the market competitions of China’s commercial banks are continually increasing, and the market concentration outcomes match with the actual market power of different types of banks; Lastly, increasing market competition has a positive effect on bank efficiency from both the profit and the cost side.

【Keywords】Bank efficiency; Stochastic frontier analysis; Market competition

目录